How to Budget for Starting an Online Business in 2025

Starting an online business in 2025 takes more than just ideas; understanding the Online Business Costs in 2025 is crucial for success. Without a clear financial plan, many businesses struggle to survive. With over 2.77 billion people shopping online, the competition is fierce. Global online sales are projected to reach $6.86 trillion this year. Effective budgeting allows you to spend wisely and avoid unnecessary expenses. Since shoppers expect quick and reliable shipping, it's important to factor in delivery costs early on. By managing your finances effectively, you can stay competitive and foster growth for your business.

Key Takeaways

Know your startup costs. Write down expenses like registration, website setup, and ads to make a clear budget.

Include regular costs. Monthly fees like hosting and payment tools can grow, so add them to your budget.

Save for surprises. Keep 10-20% of your budget for problems like shipping delays or fixing your website.

Use free tools. Try free apps and print-on-demand services to spend less while building your business.

Don’t buy extra stuff. Stick to tools and services that help your business grow.

Understanding Online Business Costs in 2025

Business Registration and Legal Costs

Starting an online business means handling legal and admin tasks. You need to register your business name and choose a structure like an LLC or corporation. Permits are also required. Fees for legal registration range from $50 to hundreds of dollars. Costs depend on your state and business type. For example, forming an LLC includes filing fees and name registration, which vary across the U.S.

Tip: Check your state’s rules to avoid surprise costs. Some states charge yearly renewal fees, so include these in your budget.

Skipping these steps can cause fines or delays. Planning ahead helps you follow rules and focus on growing your business.

Website and Ecommerce Setup

Your website is key to your online business. Whether selling products or offering services, website costs differ. Below are common expenses for 2025:

Cost Component | Estimated Cost Range |

|---|---|

Domain registration | $10–$30 yearly |

Web hosting | $5–$250 monthly |

SSL certificate | $0–$200 yearly |

Ecommerce platform (Hosted) | $20–$300 monthly |

Ecommerce platform (Open-source) | Free to download, extra fees for plugins/themes |

Website design (Prebuilt themes) | $0–$200 |

Website design (Custom) | $2,000–$20,000+ |

Additional costs (Payment gateway) | Depends on provider |

Additional costs (Digital marketing) | Based on strategy and budget |

Additional costs (Maintenance) | Depends on needed support |

A simple ecommerce site may cost $30,000–$65,000. This includes payment systems, security, and mobile-friendly design. Complex sites, like marketplaces, can cost $200,000 or more.

Note: Open-source platforms like WooCommerce seem cheap but need extra spending for plugins and support.

A good website gives users a smooth experience, helping attract and keep customers.

Marketing and Customer Acquisition

Marketing is vital for bringing visitors to your business. In 2025, customer acquisition costs (CAC) will remain important. CAC shows how much you spend to gain one customer. It helps measure the success of your campaigns.

Here’s how industries spend on marketing:

Industry | Marketing Spend Percentage |

|---|---|

Mining, Construction | 10% of revenue |

Tech, Software Platforms | 10% of revenue |

Services, Consulting | 6% of revenue |

For ecommerce, CAC varies. For example, electronics businesses spend $377 per customer. To save money, focus on effective channels and track results often.

Payment Processing Fees

Payment processing fees are a necessary part of ecommerce. These fees cover transaction handling, secure payments, and system upkeep. In 2025, knowing these fees helps you plan your budget well.

Most payment processors take a percentage of each sale. Credit card fees usually range from 1.5% to 3.5%. Extra charges, like cross-border or currency fees, add 1% to 2%. Here's a simple breakdown:

Payment Processing Fees | Percentage of Total Transactions |

|---|---|

Standard Fees | 1.5% - 3.5% |

Additional Costs | 1% - 2% |

These fees can affect your profits. For example, $10,000 in monthly sales means $150 to $350 in standard fees. Extra costs could make this amount even higher.

Tip: Compare payment processors for better rates. Stripe and PayPal offer good prices and fraud protection. Always check details to avoid surprise fees.

Including payment fees in your budget helps you plan costs and set fair prices.

Inventory and Logistics

Inventory and logistics are key parts of ecommerce. They often take up a big chunk of your budget. Careful planning stops you from spending too much.

Here are ways to manage these costs:

Use software to track inventory and avoid overstocking.

Work with third-party logistics (3PL) companies for shipping and storage.

Negotiate bulk shipping deals to lower costs per item.

Note: Free shipping attracts buyers but may increase costs. Check if extra sales cover the added expense.

Good inventory and logistics management saves money and keeps customers happy. Fast shipping and accurate stock build trust and bring repeat buyers.

How to Create a Budget for Starting an Online Business

Finding Startup Costs

Knowing how much it costs to start an online business is the first step to making a good budget. Costs can change based on your business type. They usually fit into three groups: setup costs, regular costs, and changing costs. Here's a simple list of these expenses:

Cost Type | What It Includes |

|---|---|

Setup Costs | One-time costs like licenses, website design, inventory, and supplies. |

Regular Costs | Monthly or yearly costs like hosting, subscriptions, ads, and payment fees. |

Changing Costs | Costs that go up or down, like shipping, goods, and contractor pay. |

Payroll | Paying five workers can cost about $300,500 yearly. |

Retail Startup Costs | Online retail startups may spend up to $5,000 to begin. |

Total Startup Budget | 58% of small U.S. businesses start with under $25,000. |

Focus on these groups to avoid missing important costs. For example, if you open an online store, you’ll need to pay for website design, inventory, and marketing tools. These costs can add up fast, so list them all before starting.

Tip: Use a spreadsheet to write down every cost. This keeps you organized and helps you remember everything.

Figuring Out Regular and Changing Costs

After listing startup costs, calculate regular and changing costs. Regular costs happen monthly or yearly, like hosting fees and ads. Changing costs depend on sales or business activity, like shipping or product costs.

Note: Watch changing costs closely. They can grow fast if sales increase. Planning for these changes avoids surprises.

Making a Realistic Budget

Once you know your costs, set a budget that works. A good budget covers startup and regular costs while leaving room to grow. Start by deciding how much money you can spend upfront. If funds are tight, focus on important things like your website and ads.

For example, if startup costs are $5,000 and monthly costs are $500, you’ll need $8,000 for the first six months. This gives you extra money for unexpected costs or slow sales.

A smart budget helps you manage money and build success. Careful planning lets you grow your business without worrying about running out of cash.

Setting Money Aside for Surprise Costs

Surprise costs can mess up your plans if you’re not ready. Starting an online business might bring unexpected bills. These could be higher shipping fees, fixing your website, or extra marketing costs. Saving money for these surprises keeps your business steady.

Why a Backup Fund is Important

A backup fund is like a safety plan. It helps pay for surprise bills without stopping your work. For example, if your website breaks during busy sales, you’ll need money to fix it fast. Without savings, you could lose customers and money.

Tip: Save 10–20% of your budget for surprise costs. This gives you a safety cushion without overspending.

Examples of Surprise Costs

Here are some common surprise costs you might face:

Website Problems: Fixing hosting issues or security hacks quickly.

Shipping Problems: Fuel price hikes or delivery delays can cost more.

Inventory Shortages: High demand may mean paying extra for faster production.

Marketing Changes: If ads fail, you might need extra funds to try new ideas.

Steps to Save for Surprise Costs

Follow these tips to prepare for surprise bills:

Guess Possible Risks: Think about areas like tech or shipping where surprises might happen.

Save a Percentage: Put part of your budget aside for emergencies.

Check Spending Often: Watch your spending to avoid using emergency money for regular costs.

Separate Accounts: Keep emergency money in its own account to avoid mixing it with other funds.

Why Planning for Surprises Helps

Planning for surprise costs lowers stress and keeps your business running well. It stops you from borrowing money or skipping important steps when problems happen. Being ready for surprises lets you focus on growing your business instead of worrying about money problems.

Note: Check your backup fund often to make sure it fits your needs. Change the amount as your business grows or faces new challenges.

Saving money for surprise costs is a smart move when starting an online business. It protects your work, makes your business stronger, and keeps you ready for anything.

Cost-Saving Strategies for Online Businesses

Using Print-on-Demand Services like Yoycol

Print-on-demand services, like Yoycol, help save money. They let you sell custom items, like clothes or accessories, without buying inventory first. You don’t need to worry about making or storing products. This avoids wasting money on unsold items.

Yoycol is affordable and uses advanced tools. Their 3D previews show how your designs will look before they’re made. This lowers mistakes and ensures good quality. They also check every product for bright, long-lasting prints. With 24/7 support, they help with designs, orders, and shipping issues.

Feature | Benefit |

|---|---|

No upfront costs | No need to spend money on inventory |

Competitive pricing | Affordable for new businesses |

3D previews | Helps avoid mistakes and improves design |

Quality control | Ensures happy customers with durable, colorful prints |

Using Yoycol lets you focus on growing your business while keeping expenses low.

Trying Free Tools and Software

Free tools can cut down your business costs. Apps like Canva, Trello, and HubSpot offer free versions for basic needs. Canva helps you make great marketing designs. Trello keeps tasks organized and improves teamwork. HubSpot offers free tools for managing customers, emails, and tracking data.

Remote work tools also save money.

Tip: Test free trials or free plans before paying for upgrades. Many tools have strong free features.

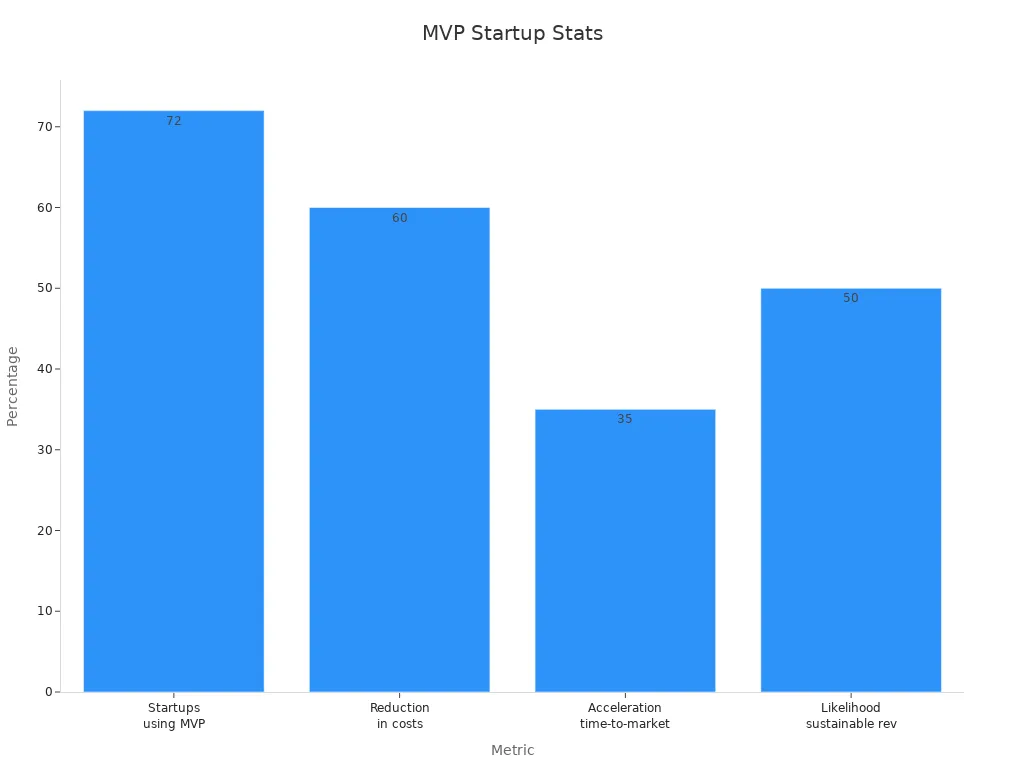

Starting Small with a Minimal Viable Product (MVP)

An MVP is a simple version of your product. It lets you test your idea without spending too much. This approach focuses on the main feature of your product or service. It saves money and gets your product to customers faster.

About 72% of startups using an MVP succeed. This method cuts development costs by 60% and helps businesses earn steady income 50% more often. Starting small lets you improve your product based on feedback and grow smarter.

For example, if you’re making an app, focus on its main feature first. Launching an MVP saves money and ensures your product fits customer needs. This strategy helps you succeed while spending less.

Hiring Freelancers for Specific Tasks

Freelancers can help save both time and money. Instead of hiring full-time workers, pay freelancers for specific tasks. This way, you can focus on growing your business while keeping costs low.

Freelancers are skilled in areas like design, writing, or coding. They deliver quality work without needing a long-term job contract.

Tip: Write clear project details before hiring. This helps you find the right freelancer and avoid extra costs.

Hiring freelancers gives you access to top talent, lowers expenses, and helps your business grow.

Partnering with Micro-Influencers

Micro-influencers are great for marketing your business. These influencers have 10,000 to 100,000 followers. They offer a cheaper way to reach your audience. Their smaller, loyal follower base often brings better results than big influencers.

Businesses using micro-influencers see strong returns. On average, they earn $6.50 for every $1 spent.

Insight: Micro-influencers share real content, building trust with followers. This trust leads to more engagement and better sales for your business.

Why micro-influencers work:

Affordable: They charge less than big influencers.

Focused Audience: They connect with specific groups that match your brand.

More Interaction: Their followers engage more, boosting sales chances.

Pick influencers who share your brand’s values. Let them promote your products in their own way. This makes your business seem real and trustworthy.

Working with micro-influencers can boost sales and create loyal customers for your business.

Using Budget-Friendly Tools and Services

Print-on-Demand Services (e.g., Yoycol)

Print-on-demand services like Yoycol help you save money. These platforms let you sell custom items without keeping stock. Yoycol is affordable, with no minimum orders and free design tools. You only pay for what you sell, lowering risks.

Cost Benefit | Details |

|---|---|

Low Base Costs | Yoycol’s prices help you earn more profit. |

No Minimum Orders | Order only what you need to avoid extra spending. |

Free Design Tools | Use tools like 3D previews to improve designs for free. |

Yoycol makes it easy to grow your business while keeping costs low.

Free Marketing Tools (e.g., Buffer, HubSpot)

Free marketing tools are great for saving money. Buffer helps you manage social media by scheduling posts and tracking clicks. This saves time and boosts engagement. HubSpot combines tools for marketing, sales, and customer service. Its CRM tracks customer activity, helping you close deals faster.

For new businesses, Buffer and HubSpot offer useful features at no cost. They simplify marketing so you can focus on growing your store.

Low-Cost Ecommerce Platforms (e.g., Shopify, Etsy)

Picking the right ecommerce platform can save you money. Shopify and Etsy are affordable options. Shopify’s basic plan costs $19 monthly. Etsy charges $0.20 per listing and has an optional $10 monthly plan. Both platforms have transaction fees, but they’re great for small businesses.

Platform | Cost Details | Transaction Fees | Extra Fees |

|---|---|---|---|

Shopify | $19/month (Basic Plan) | 0.5%–2.0% (third-party) | 2.9% + $0.30 per sale (payment processing) |

Etsy | $0.20/listing, $10/month | 6.5% of sale price | 3% + $0.25 per sale, 2.5% for currency conversion |

Knowing these costs helps you pick the best platform. Shopify and Etsy are affordable ways to start and grow your online store.

Budget-Friendly Website Builders (e.g., Wix, WordPress)

Picking the right website builder saves both time and money. Wix and WordPress are great choices for starting an online business in 2025. They help you create professional websites without needing advanced tech skills.

Wix is simple and quick to use. Its Business Plan costs $36 monthly and includes hosting, security, and key features. You can set up a small store in 4 to 8 hours. This makes it perfect for beginners who want fast results and clear costs.

WordPress gives more options but takes longer to set up. The platform is free, but you’ll pay for hosting, themes, and plugins. These extras cost $50 to $90 monthly, depending on your needs. Building a WordPress site takes 8 to 15 hours but allows for more customization as your business grows.

Here’s a simple comparison:

Wix combines hosting, security, and features in one plan, keeping costs simple.

WordPress needs separate hosting and plugins, which cost more but offer flexibility.

If you’re new, Wix is easier and faster. If you want advanced features later, WordPress is worth the effort. Both platforms help you control web hosting costs while looking professional.

Tip: Think about your goals and skills before picking a platform. This helps you choose one that fits your budget and timeline.

Common Mistakes to Avoid When Starting an Online Business

Spending Too Much on Unnecessary Things

Starting an online business can tempt you to buy extra stuff. Fancy gadgets, pricey software, or top-tier tools might look cool but waste money. Focus only on what your business needs to run well. Instead of buying expensive tools, try free or cheaper options that work just as well.

Keep track of every dollar you spend. Use a simple spreadsheet or a budgeting app to see where your money goes. This helps you spot areas where you’re spending too much. Saving money here means you can use it for important things like marketing or growing your business.

Tip: Before buying, ask, “Will this help my business grow?” If not, skip it.

Skipping a Business Plan

Not having a business plan is a big mistake. A plan is like a guide that shows your goals, audience, and budget. Without it, you might lose focus and spend money on the wrong things.

Your plan should include a budget, marketing ideas, and a timeline for your goals. For example, decide how much to spend on ads each month and which platforms to use. This keeps you organized and stops you from wasting money.

Insight: Businesses with plans succeed more because they use their money wisely.

Forgetting Legal and Tax Rules

Ignoring legal and tax rules can cost you a lot. Make sure to register your business and learn the tax laws in your area. Get the right licenses and permits to avoid problems later.

Keep good financial records to make taxes easier. Use accounting software or hire someone to help. Staying organized avoids legal trouble and lets you focus on growing your business.

Note: Check the rules for your business type and location to avoid surprises.

Skimping on Marketing Efforts

Skipping marketing can hurt your online business. Marketing isn’t just spending money; it helps your business grow. Without regular marketing, it’s hard to get and keep customers. In 2025, digital ads cost more, making it pricey to find new clients. Taking care of current customers with personal service becomes even more important.

Businesses that focus on customer experience grow their revenue by 80%. This shows how not spending enough on marketing can harm your profits. Personalized marketing matters a lot. Around 86% of marketers say customers feel their experience is personal. Plus, 94% agree personalization boosts sales. Ignoring this trend could leave your business behind others who use tailored strategies.

Marketing needs effort over time. Cold leads may need 20 to 50 contacts before buying. Warm leads still need 5 to 12 touches to make a purchase. These numbers prove why steady marketing is key. Without it, you might lose customers to businesses that stay active and visible.

Statistic | What It Means |

|---|---|

80% higher revenue growth for businesses focusing on customer experience | Shows the risk of not investing in marketing that improves customer experience. |

20 to 50 touchpoints needed for cold leads | Explains why ongoing marketing is needed to turn new customers. |

5 to 12 interactions needed for warm leads | Shows that even interested customers need regular engagement to buy. |

To avoid problems, make a marketing plan that includes getting new customers and keeping old ones. Use tools like emails, social media, and special offers to connect with people. Regular marketing builds trust, keeps your brand noticed, and helps your business succeed.

Tip: Set aside part of your budget for marketing. This ensures you have enough money to stay competitive and grow your business.

Budgeting is key to starting a successful online business. It shows startup costs and helps plan regular expenses. Smart money management stops overspending and supports growth.

Using cost-saving tools like Yoycol reduces risks and boosts profits. These methods make running your business easier and keep you ahead of others.

Start now. Make a budget, find affordable tools, and begin building a strong online business.

FAQ

What’s the smallest budget to start an online business?

Many online businesses begin with under $25,000. If money is tight, you can start with $5,000. Focus on key things like your website, ads, and products.

How do I save money on marketing?

Try free tools like Canva for designs and Buffer for social media. Work with small influencers to reach specific groups cheaply. Use strategies like SEO and email to save money.

Is a business plan needed before starting?

Yes, a plan helps you set goals and track spending. It keeps you organized and stops wasteful spending. Without one, you might lose focus and overspend.

Which platforms are best for making a website?

Wix and WordPress are great choices. Wix is easy to use and includes hosting. WordPress gives more options but needs extra tools. Pick based on your skills and budget.

How can I handle surprise costs?

Save 10–20% of your money for emergencies. Common surprises include fixing websites, shipping delays, or running out of stock. Keep this money in a separate account to stay prepared.

See Also

Essential AI Tools For Every eCommerce Company Today

Best Summer Items To Enhance Your eCommerce Revenue

Easy Ways To Earn Cash Selling On eBay